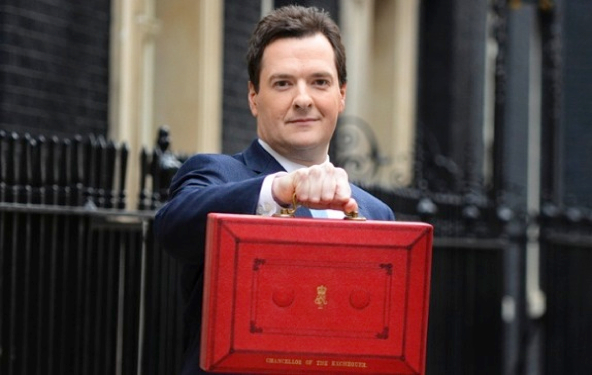

Budget 2013: Car Headlines 21 | 03 | 2013

CHANCELLOR GEORGE OSBORNE announced a number of measures which will have a direct impact on the motor industry. While the decision to freeze fuel duty again caught the headlines, there were also changes in other areas, including Vehicle Excise Duty and Company Car Tax.

FUEL: The 1.89p per litre fuel duty increase that was planned for September 1, 2013 has been cancelled. It means fuel duty will have been frozen for nearly three-and-a-half years, the longest duty freeze for over 20 years.

VEHICLE EXCISE DUTY: From April 1, 2013, VED rates will increase in line with RPI, apart from VED rates for HGVs which will be frozen in 2013/14.

The Government has ruled out plans to make significant reforms to the structure of VED for cars and vans in the current Parliament having previously said that it had been considering changes to ensure that all motorists made a fair contribution to the sustainability of the public finances, and to reflect continuing improvements in vehicle fuel efficiency.

COMPANY CAR TAX: From April 6, 2015, two new company car tax bands will be introduced, at 0-50g/km CO2 and 51-75g/km CO2. The appropriate percentage of the list price subject to tax for the 0-50g/km CO2 band will be 5% in 2015-16, and 7% in 2016-17. The appropriate percentage of the list price subject to tax for the 51-75 g/km CO2 band will be 9% in 2015-16 and 11% in 2016-17. In 2017-18 there will be a 3percentage point differential between the 0-50 and 51-75 g/km CO2 bands, and between the 51-75 and 76-94g/km CO2 band. In 2018-19 and 2019-20 there will be a 2 percentage point differential between the 0-50 and 51-75g/km CO2 bands and between the 51-75 and 76-94g/km CO2 bands.

All other company car tax rates up to the end of the 2016/17 financial year were announced in last year’s Budget.

In future years, company car tax rates will be announced three years in advance.

Additionally, the Government says it will review company car tax ‘incentives’ for ultra low emission vehicles in light of market developments at Budget 2016, to inform decisions on company car tax from 2020-21 onwards.

CORPORATION TAX: Changes to the main rate of Corporation Tax mean the UK will have the lowest rate in the G20 and result in more profit on companies' bottom line. From April this year, the main rate of Corporation Tax is reduced to 23%, with a further 3% cut by April 2015 to 20%.

INCOME TAX: Consumers will have more money in their pockets following the decision to increase the annual income tax allowance to £9,440 from April this year. This will be followed by another rise of £560 in April 2014, taking the level to £10,000.

STATUTORY OFF ROAD NOTIFICATIONS (SORN): In a bid to make savings on administration costs, SORN will now last indefinitely and not require renewing every year. The grace period for not displaying a tax disc, once you have paid for it, has also been extended to 14 days.

BENEFIT-IN-KIND TAX (BiK): From April 2015, BiK will be 5% of the P11D value of electric vehicles, instead of the 13% previously announced.

LOW CARBON CARS: An increase in demand is likely following the decision to extend the 100% relief for businesses acquiring low carbon cars. The 100% relief now runs through to March 2018.

CAPITAL ALLOWANCES: The Government will extend the 100% full year allowance — due to end on March 31, 2015 — for a further three years until March 31, 2018. From April 1, 2015, the carbon dioxide emissions threshold at which the allowance applies will be reduced from 95g/km to 75g/km. The case for extending the full year allowance for cars beyond April 1, 2018 will be reviewed at Budget 2016 alongside a review of the 130g/km main rate threshold (18%).

VAN BENEFIT CHARGE: The Government will freeze the van benefit charge at £3,000 in 2013/14.

CAR FUEL BENEFIT CHARGE (FBC) 2013–14: From April 6, 2013, the FBC multiplier for company cars will increase from £20,200 to £21,100, and will increase by RPI in 2014/15.

VAN FUEL BENEFIT CHARGE (FBC) 2013–14: From April 6, 2012, the van FBC multiplier will be frozen at £550, and will increase by RPI in 2014/15.

Keep up-to-date with all the latest news by following us on twitter.com/scotcars

Jim McGill