Scots new car market down 7.96% 08 | 01 | 2018

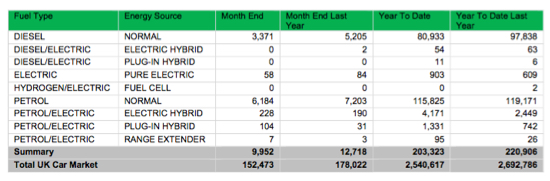

SCOTLAND’S NEW CAR market shrunk by 7.96% last year compared with 2016, representing a drop of 17,583 registrations, down from 220,906 units to 203,323 in 2017. Sales in December were down 21.75% compared to the same month in 2016. (Related: UK car registrations fall 5.7% in 2017)

But while the Scottish Motor Trade Association admitted the combined results were “disappointing”, it stressed it would be “wrong to suggest the industry is surprised, or even shocked, to read the results”. And it highlighted Scottish dealers’ strong development of used cars sales.

While the Scottish annual new car figures show an increased percentage fall compared to the UK average of 5.7%, the SMTA highlighted a number of core reasons behind the disappointing figures.

While diesel numbers have been particularly hard hit, similar to the UK results, and uncertainty continues over the fallout effects from Brexit, the SMTA pointed its finger at the lack of detail supplied by the Scottish Government in its drive towards cleaner urban areas.

Clean and green campaigners will be quick to highlight the fact Scotland witnessed a 68.5% increase in sales of alternative fuelled vehicles, including all-electric and hybrid.

But the harsh reality is that represents a paltry 2668 units, and just 3.23% of the Scottish new car market.

Across the country, Scotland continued to buck the UK trend, with private/retail sales remaining strong, accounting for almost 50% of all cars sold in the country.

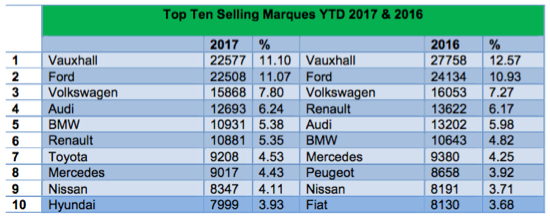

Vauxhall retained its position as Scotland’s No1 seller, accounting for an 11.10% share of the market with 22,577 units sold. But that figure is down 5181 units on 2016, when Vauxhall took a 12.57% share.

Ford closed the gap dramatically in 2017, finishing just 69 cars behind Vauxhall with 22,508 sales (11.07% share). VW (15,868/7.80%), Audi (12,693/6.24%) and BMW (10,931/5.38%) completed the top five. Renault, Toyota, Mercedes, Nissan and Hyundai also made it into the top 10.

Vauxhall also had the topselling model in Scotland last year, in the shape of the Corsa (8290 units), beating the Ford duo of Fiesta (6793) and Focus (5374) into second and third respectively. The VW Polo (4866) and Vauxhall Astra (4607) completed the top five.

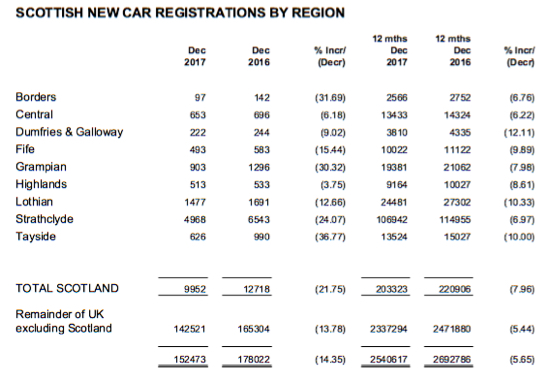

Every Scottish region saw sales fall compared with 2016, with the biggest percentage drop in Dumfries & Galloway, down by 12.11% from 4335 to 3810 last year.

In terms of volume, by far the largest drop was in Strathclyde which saw 8013 fewer new cars registered in 2017 compared to the previous 12 months, a drop of 6.97%.

Elsewhere, Lothian sold 2821 (-10.33%) fewer cars, with the trend mirrored in Grampian, where the drop was 1681 units (-7.98%) and Tayside, down 1503 unites (-10%).

“Whilst the level of decline on last year’s numbers is very disappointing,” Sandy Burgess, SMTA chief executive said, “it would be wrong to suggest the industry is surprised, or even shocked to read the results.

“We have, for a very significant time now, been reporting on these results as having a very large ‘tactical registrations’ content.

“Over the last few months of 2017 we have been aware that a number of our larger dealers have been moving away from the process of driving registrations, towards a more balanced business model with the additional funding being directed to developing their used vehicle operations.

“I am delighted to confirm has been very successful with record levels of quality used cars being sold.

“This is good news for everyone as high levels of used cars sales build strong demand for used cars in the trade and that in turn creates a stronger platform for the new retail consumer when looking for the very best deal on their part exchange vehicle.”

The SMTA has suggested the level of decline in Scotland over 2018 will continue to exceed that experienced by the rest of the UK, unless there are significant changes in manufacturer strategies.

“If the true market is recorded as opposed to the ‘massaged figures’ we have become accustomed to,” Burgess continued, “we may well see a market drop this year of between 15 and 20%. This, however, could well be mitigated by the aforementioned strong retail/private buyer within our market place.”

Related: Scots new car sales fell by a quarter

Keep up-to-date with all the latest news by following us on twitter.com/Scotcars

Jim McGill

All figures supplied by the SMMT